Things to Watch in Markets this week:

1.Fed meeting:Fed policymakers will hold their first meeting since Democrats last week took control of the Senate, which has increased the likelihood that new President Joe Biden’s proposed $1.9 trillion stimulus package could be passed.

The Fed is not expected to make any policy changes at the conclusion of its two-day policy meeting on Wednesday and is likely to reiterate that the economy is still far from its goals of full employment and 2% inflation.(source:investing.com)

2.U.S. GDP data:Market participants will get their first look at how the U.S. economy performed in the fourth quarter from Thursday’s figures on gross domestic product after already weaker consumer spending numbers and falling employment in December.

After a record 33.4% annualized rate of growth in the third quarter, economists are forecasting growth of 4.0% in the final three months of the year. The economy is expected to have contracted by 3.5% for the full year.The economic calendar also features data on durable goods orders on Wednesday, initial jobless claims numbers on Thursday and personal income and spending data on Friday.

3.Euro zone:In the euro zone fourth quarter GDP from France and Spain on Friday will confirm their economies contracted in 2020.Germany, the euro area’s largest economy will publish GDP data on Friday, which is to confirm its economy shrank by a smaller than feared 5.0% in 2020, as unprecedented government rescue and stimulus measures helped lessen the shock of the pandemic.

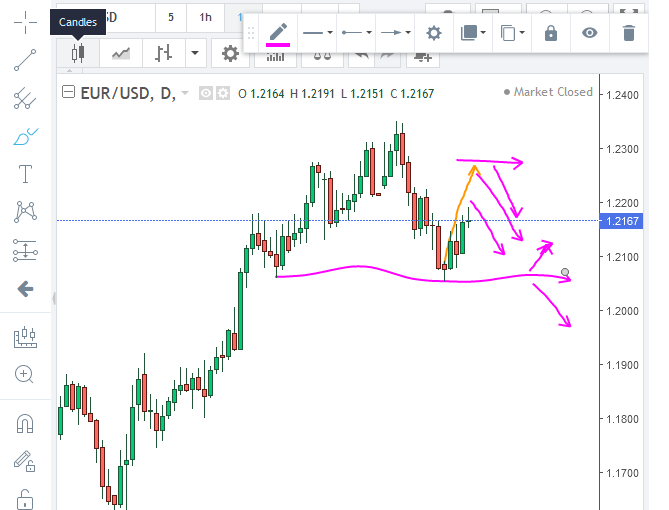

EUR/USD Forecast: Euro is still in bullish mode with short term correction.But lots off trader are taking their profit and looking to their sell opportunities. 1.2250-1.2450 is a good sell entry point for euro.

EURUSD weekly forecast

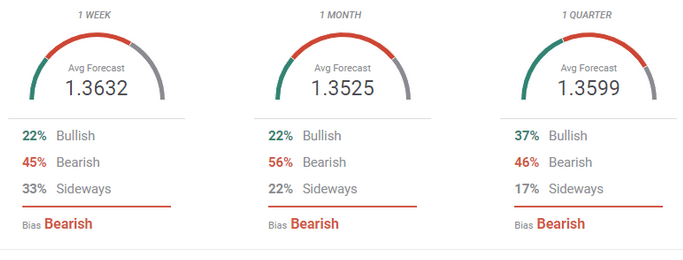

GBPUSD forecast:Pound has shown strong gain last few weeks,but it has limited upward movement arround 1.3730-1.3750 area and lots of noise in uptrend.The FXStreet Forecast Poll is showing that experts are not buying the recent rise above 1.37 and forecast significant falls in all timeframes. The average targets are little changed.

Bitcoin Weekly Forecast: BTC is on track to $100,000 despite the recent correction

- Bitcoin price plummeted from $35,600 down to 28,850 in less than 48 hours.

- BTC bulls have bought the dip pushing the digital asset above $32,000.

- On-chain metrics and several other indicators show Bitcoin is still poised to hit $100,000 in the long-term.

- The Stock-to-Flow predictive model for Bitcoin remains extremely accurate.

USDJPY forecast:It may some short term correction,but it will be uptrend soon.USD/JPY sees limited movement as US economy waits for stimulus.

Resistance: 103.85; 104.25; 104.50; 105.00; 105.50

Support: 103.50; 103.00; 102.70

Gold forecast:Gold’s price has been advancing as President Biden took office and promoted stimulus.The precious metal’s next moves depend on bipartisan support and vaccine progress. Late January’s daily chart is painting a mixed picture. The FX Poll is pointing to long-term gains.

It may go up for Biden’s new stimulus package and suddent corona virus cases new variant,but also chance to create new lower low.

warning: Don’t be a looser and not take any huge risk without proper money management.

Excellent information. It was helpful for me to read this article. I recently chose the best forex broker in india according to Traders Union and started trading in the market. I am completely satisfied with my choice.

ReplyDelete